In the vast world of credit cards, it can be challenging to find a product that genuinely stands out. The CommBank Neo Credit Card, however, is here to offer a unique experience tailored to modern spending habits. This card is designed for those who are tired of unexpected fees and are looking for a straightforward option to manage their finances without the burden of interest.

If you’re someone who appreciates flexibility, convenience, and simplicity in your financial tools, this card might be the one you’ve been searching for. With its refreshing approach to everyday spending and some standout features, it ensures a stress free experience without hidden surprises. Let’s dive deeper to discover what makes this credit card a game changer.

CommBank Neo Credit Card: Smart Spending Simplified

- No Interest, Ever: Say goodbye to the stress of accruing interest. The CommBank Neo Credit Card eliminates interest charges entirely, allowing you to focus on spending within your budget.

- Predictable Monthly Fees: This card replaces fluctuating costs with a single, fixed monthly fee based on your credit limit. Whether you choose a $1,000, $2,000, or $3,000 credit limit, you’ll always know exactly what you’re paying each month.

- Generous Cashback Rewards: Enjoy cashback on eligible purchases, putting money back into your pocket just for using your card. Whether it’s dining out, shopping, or paying for services, you can accumulate rewards that genuinely make a difference.

- Budget Control Made Easy: With the CommBank Neo Credit Card, managing your budget becomes more straightforward. The card’s structure helps you avoid overspending by offering a clear credit limit and monthly fee.

- Zero International Transaction Fees: Traveling or shopping online from international stores is made easy with no added fees for foreign transactions.

- No Late Payment Fees: Late fees are a thing of the past with this card. If life gets in the way and you miss a payment, the CommBank Neo Credit Card has your back with no penalty fees.

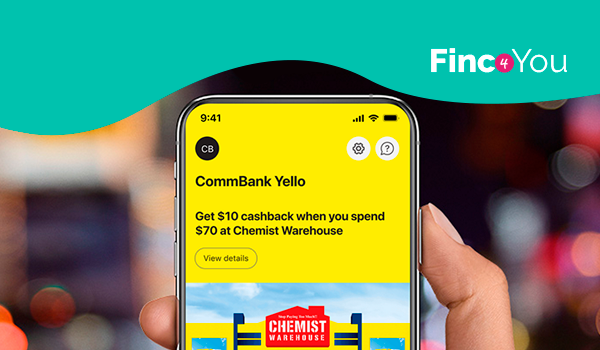

- Access to CommBank Rewards: As a cardholder, you get access to exclusive CommBank Rewards, giving you discounts on various brands and services. This perk lets you save even more on your regular spending, making it a win-win situation for those looking to stretch their dollar further. The rewards are regularly updated, so there’s always something new to take advantage of.

- Enhanced Security Features: Rest easy knowing your card is protected with the latest security technologies. From real time transaction notifications to secure online shopping protection, CommBank ensures your details are safe.

- Effortless Digital Integration: With seamless integration into the CommBank app, managing your account is easier than ever. You can track spending, pay bills, and set reminders all from your smartphone.

Qualification Requirements

- Australian Residency: To apply, you must be an Australian citizen or a permanent resident. This ensures the card remains accessible to those who are based in the country and want a local financial solution tailored to their needs.

- Minimum Age Requirement: Applicants need to be at least 18 years old. This is in line with the legal age for financial contracts in Australia, ensuring responsible lending practices.

- Stable Source of Income: You must have a steady income source to qualify. Whether it’s a fulltime job, part-time employment, or self-employment, proof of earnings will be required.

- Good Credit History: Maintaining a solid credit record is essential. Applicants with a history of unpaid debts or defaults may find it challenging to get approved.

- Valid Identification: You’ll need to provide valid Australian ID documents, such as a driver’s license or passport, to confirm your identity and residency status.

- Active Bank Account: An active Australian bank account is required for the application process, which helps streamline verification and future payments.

How to Apply for The CommBank Neo Credit Card

- Visit the CommBank Website: Start by visiting the official Commonwealth Bank website, where you can find the application form for the Neo Credit Card. The process is entirely online for your convenience.

- Complete the Online Form: Fill out the application form with your personal information, including your name, address, and contact details. Ensure all the information is accurate to avoid delays.

- Submit Identification Documents: You’ll need to upload scanned copies of your identification documents. This can include your driver’s license, passport, or Medicare card.

- Provide Proof of Income: Attach your latest payslips or bank statements to verify your income. Self Employed applicants may need to submit tax returns or business statements.

- Review and Confirm Details: Before submitting, review all the details to ensure accuracy. Any mistakes can delay the application process, so double check before clicking submit.

- Await Approval: Once submitted, your application will be reviewed, and you’ll receive an update within a few business days. If approved, your card will be mailed to you promptly.

Frequently Asked Questions

What is the CommBank Neo Credit Card’s main advantage?

The main benefit is the absence of interest charges, making it a straightforward choice for everyday purchases.

Is there a cashback feature on this card?

Yes, you can earn cashback on eligible transactions, helping you save money as you spend.

Can I use the card for international purchases?

Absolutely! There are no international transaction fees, so it’s ideal for global online shopping or when traveling overseas.

What should I do if my card is lost or stolen?

Simply report it through the CommBank app or call their customer support to block and replace your card swiftly.

Bankwest Breeze Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;line-height: 25px; color:#444444 !important;'> Unlock savings and a low-rate balance transfer today! Enjoy flexible options tailored to your lifestyle needs. </p>

Bankwest Breeze Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;line-height: 25px; color:#444444 !important;'> Unlock savings and a low-rate balance transfer today! Enjoy flexible options tailored to your lifestyle needs. </p>  ANZ Rewards Black Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;line-height: 25px; color:#444444 !important;'> Unlock the power of your spending with the ANZ Rewards Black Credit Card—where every purchase takes you further. </p>

ANZ Rewards Black Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;line-height: 25px; color:#444444 !important;'> Unlock the power of your spending with the ANZ Rewards Black Credit Card—where every purchase takes you further. </p>  Bendigo Ready Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;line-height: 25px; color:#444444 !important;'> Experience the convenience and flexibility you deserve with Bendigo Ready Credit Card! Get access to exclusive perks now. </p>

Bendigo Ready Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;line-height: 25px; color:#444444 !important;'> Experience the convenience and flexibility you deserve with Bendigo Ready Credit Card! Get access to exclusive perks now. </p>