Managing your finances can be challenging, but top Australian budgeting apps offer effective solutions to simplify the process. These apps help you track expenses, set budgets, and achieve financial goals.

Discover the best features of these apps, learn how to choose the right one for your needs, and understand the benefits they provide. With various options available, finding the perfect budgeting app for your lifestyle is easier than you think. Let’s explore the popular budgeting apps used by Australians to keep their finances in check.

Best Features of Australian Budgeting Apps

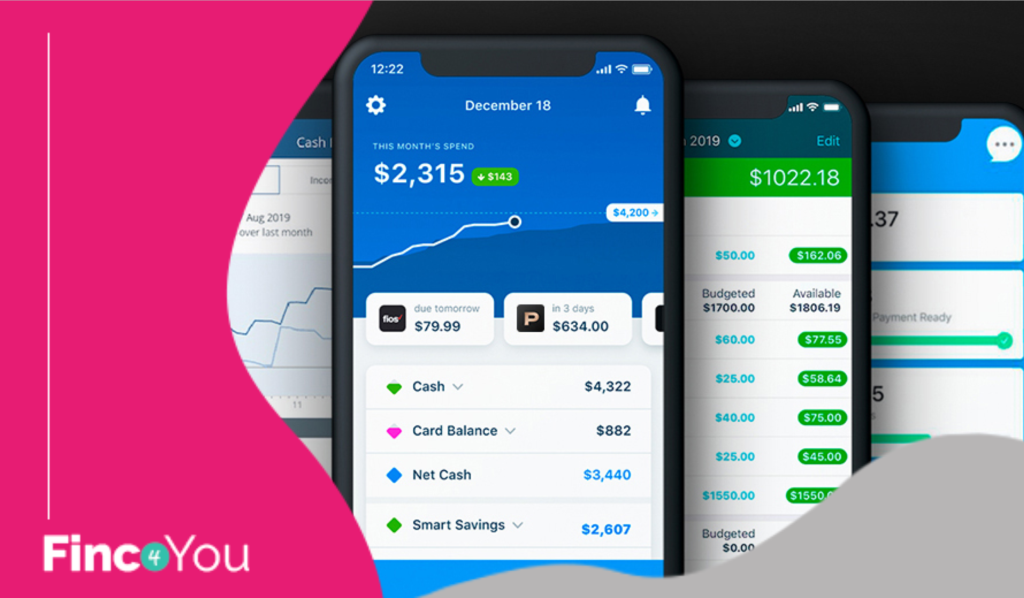

When evaluating the best features of Australian budgeting apps, it’s essential to focus on what sets them apart. One critical feature is the intuitive user interface. An easy-to-navigate app ensures users can manage their finances without unnecessary complications.

Another indispensable feature is the capability for real-time expense tracking. This functionality allows users to log and categorize expenses promptly, providing an up-to-date snapshot of their financial situation. It’s crucial for users who want to stay on top of their spending habits.

Customizable budgeting categories are also a significant draw. Apps that allow personalization of spending categories help cater to unique financial goals and priorities. Users can allocate funds to specific areas, from groceries to entertainment, ensuring tailored financial management.

Many top applications offer integration with bank accounts. This feature simplifies the process of tracking finances by automatically updating transactions. Seamless integration can save users time and effort, contributing to a more streamlined budgeting experience.

A strong focus on data security is crucial for any budgeting app. Ensuring that user data is protected through encryption and secure login methods builds trust and confidence in the app’s reliability.

Moreover, having goal-setting features can motivate users to save. Setting short or long-term financial goals within the app can provide guidance and encouragement. Users can track progress, making it easier to stay focused on their financial objectives.

Reports and analysis features offer insights into spending patterns, helping users make informed decisions. Visual tools such as charts and graphs make it easier to interpret data, showing trends and areas where spending can be adjusted.

Finally, customer support is a feature that shouldn’t be overlooked. Responsive support teams can provide valuable assistance, ensuring users can resolve any issues promptly and continue managing their budgets effectively.

How to Choose the Right Budgeting App

Choosing the right budgeting app requires a clear understanding of your personal financial goals. Define Your Needs: Are you looking to save money, track your expenses, or do you want a complete financial overview? Different apps serve different purposes. Compare Features: Look for apps offering features you need. Some offer detailed expense tracking, savings goals, or bill reminders. Ensure the app supports Australian banks for seamless integration.

Ease of Use is crucial. A user-friendly interface makes it easier to manage budgets regularly. Free trials can help test whether the app’s navigation suits your preferences.

Consider Security and Privacy. Check if the app offers strong encryption and privacy policies to keep your financial data safe. Reading user reviews can provide insights into any security issues faced by other users.

Analyze Cost vs. Value. Some apps are free, while others require a subscription. Decide if the app’s cost aligns with its benefits and your budgeting needs.

Customer Support and community engagement are significant. Good support can resolve issues quickly, enhancing your app experience. Forums or support chats can also be useful for exchanging tips or solutions.

Benefits of Using Budgeting Apps

Embracing budgeting apps can profoundly transform personal finance management. These digital tools offer a convenient and efficient way to track expenditure and incomes. By automating the tracking process, they reduce manual data entry errors and bring an accurate picture of your financial status at your fingertips. Users can monitor spending habits and identify areas to cut costs, promoting better financial discipline.

Additionally, most budgeting apps provide insights and analytics, equipping individuals with the knowledge to make informed financial decisions. This feature is particularly beneficial in a dynamic economic landscape, as it enables users to adjust their budgets based on reliable data promptly.

Furthermore, these apps often include goal-setting features, helping users to set and achieve savings objectives. Whether it’s saving for a vacation, a new car, or debt repayment, having a visual representation of progress can boost motivation and commitment.

Budgeting apps also offer the capability to categorize expenses, offering clarity and understanding of one’s financial priorities. This transparency aids in aligning spending with financial goals and ensuring that essential expenses are prioritized.

For families or couples managing a household budget, the sharing and collaboration features of many apps encourage joint accountability and open discussions about financial matters, fostering a healthier financial environment.

Popular Budgeting Apps in Australia

- Pocketbook: This app is one of the most popular budgeting tools in Australia, offering features like categorizing expenses, tracking income, and setting budgets. Its seamless integration with Australian banks makes it a favorite among users.

- Money Brilliant: Known for providing a comprehensive overview of your finances, Money Brilliant helps Australians manage their money better. The app provides insights into spending, saving, and helps in achieving financial goals.

- Goodbudget: A digital version of the envelope budgeting system, Goodbudget is ideal for users who want to share a budget plan with family members. It supports manual expense tracking and budgeting, helping users stick to their financial plans.

- Frollo: Combining budgeting tools with a focus on financial wellness, Frollo connects accounts from a variety of banks to give you a consolidated view of your finances. It also offers a personal finance score and insights.

- WeMoney: WeMoney not only helps with budgeting but also focuses on reducing debt. It offers features like account aggregation, reminders, and a community feel, allowing users to share tips and experiences.

Choosing the Best App

Before selecting a budgeting app, consider what features are most important to you, such as bank integration, goal setting, or sharing capabilities. Many of these apps offer free versions with premium upgrades for additional features.